Value Investing and Importance of Replacement Cost

What is Value Investing? In the 1920s, Benjamin Graham, an American economist, investor, and lecturer, pioneered a new style of stock investment called ‘Value Investing.’ He is renowned as the “Father of Value Investing,” and his approaches are still followed by notable investors like Warren Buffet and Peter Lynch. By simply analyzing firms with fine […]

Value Investing & Behavioral Finance – Part 2

Hello Strategic Alpha Tribe, We value your time and promise to only send you content that we consume ourselves. We believe the more we learn the more we earn. Charlie Munger Says On the same note, we are uploading a super learning video on our YouTube channel, A Book session on “Value Investing and Behavioral Finance- […]

Aur Kitna Niche Jayega – No Stock is Safe

Many investors underestimate the extent to which a stock can fall. Let’s take the example of the real estate company Unitech. The stock was trading at Rs 520 in January 2008. In January 2013, the stock was at Rs 40. Looking at the fact that the stock crashed by more than 90% in these 5 […]

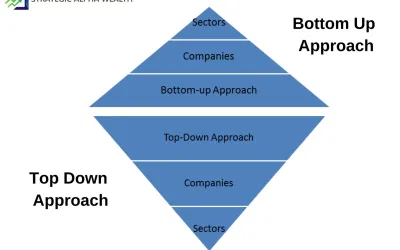

Difference between Top down approach and Bottom Up approach of Researching Stocks

Top-down and bottom-up are two approaches to investing. Let’s look at what each of these two approaches means. Under the top-down approach, an investor looks at the big picture. An investor first chooses which sector is going to do well. Then he moves on to find which companies in the sector are worth investing in. […]