The Conviction Club- Knowledge Series Post : (Report Date- 11th Jan 2024)

What is HRITIK?

HRITIK is an abbreviation for six stocks, namely HDFC Bank, Reliance Industries, Infosys, TCS, HDFC, ICICI Bank and Kotak Mahindra Bank. These 6 Nifty heavyweights account for 39.6 percent of the index weightage.

HRITHIK stocks have an enormous impact in the Indian market and possess a combined market capitalization that is bigger than the size of most national economies. HRITHIK stocks are considered the FAANG of India

| Company & Stock Symbol | Weightage | Industry |

| HDFC Bank (HDFCBANK) CMP 1 | 13.26% | Financial Services |

| Reliance Industries (RELIANCE) | 9.11% | Oil & Gas |

| ITC (ITC) | 4.37% | FMCG |

| Tata Consultancy Services (TCS) | 4.05% | Information Technology |

| Infosys (INFY) | 5.89% | Information Technology |

| Kotak Mahindra Bank (KOTAK BANK) | 2.93% | Financial Services |

| Total | 39.61% |

Why HRITIK fundamentally makes sense rather than owning a Nifty ETF at this stage?

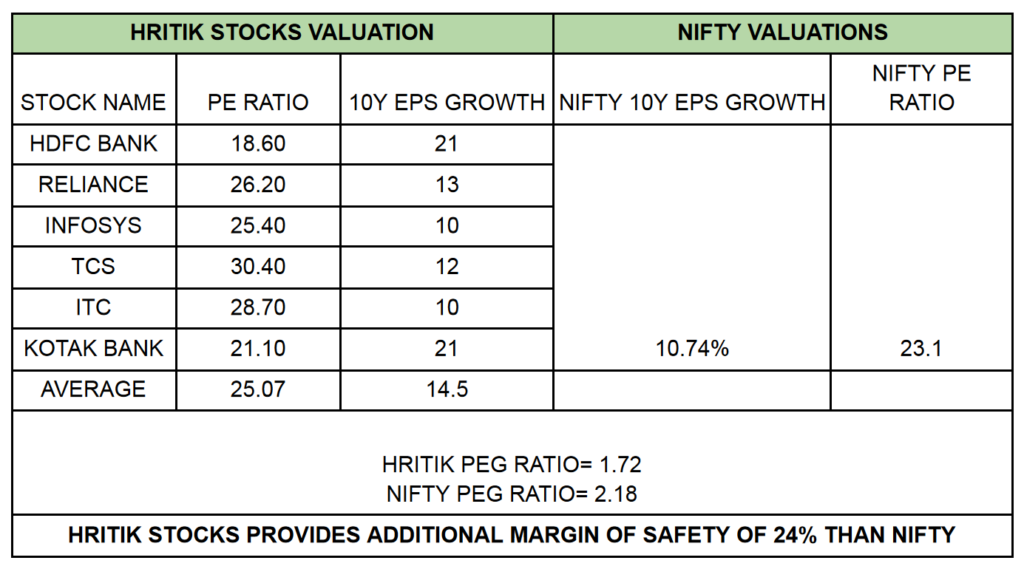

PE Ratio of HRITIK stocks is 25 and a 10 Year EPS Growth of 14.5% CAGR giving us a PEG Ratio of 1.72 , whereas NIFTY PE Ratio stands at 23.1 and has a 10 years EPS growth of 10.74% CAGR giving us a PEG ratio of 2.18.

From above data it is quite evident that HRITIK stocks provides an additional margin of safety of 24% in valuations based on PEG Ratio compared to NIFTY50. There is a higher possibility of EPS Growth in HRITIK stocks than Nifty.

Especially when one is expecting a tsunami of foreign investment happening over the next 6 months, based on this blog. For someone who doesn’t want to take exposure to the cyclical sector like Metals and Old Economy, they can prefer structural growth story of HRITHIK.

Why investing in HRITIK stocks makes sense technically, rather than owning a Nifty ETF at this stage?

Conclusion

Creating a portfolio of HRITIK stocks will stand the test of time. The companies have good cash flows, higher profitability, dependable balance sheets, management capabilities to wither downtrends.

Very important note: The objective of this blog is to share knowledge and info about multi-bagger ideas/opportunities. Neither is this trading website nor an analyst website nor a Buy/Sell call website. For stock market success, always do your homework, own analysis, and make your own decisions. StrategicAlpha is not a SEBI Registered Investment Advisor/Research Analyst, The content should be consumed only from a educational perspective.

If you liked the content, Don’t Forget to share it among your friends and family : Share on Whatsapp

Join Our Upcoming Webinar on Techno Value Investing Here

Important Links-

Email- contact@strategicalpha.in

Website- www.strategicalpha.in

Blog- https://www.strategicalpha.in/blog/

Youtube- https://www.youtube.com/@StrategicAlpha

Twitter- https://twitter.com/suyog_dhavan

Telegram- https://t.me/strategicalpha

Join Our Upcoming Annual Symposium on 10th Feb 2024- Mumbai – Click Here